Programme slogan: Understanding the complex world of finance

Example Curricula

This chapter provides examples of how economics programmes could look and be structured. Such proposals help make the debate concrete and bring out potential trade-offs. This is important because critics of current programmes often simply ask to teach more and more, without considering practical limits on time and content. Curriculum proposals help us to flesh out not only what could be added to a programme, but also what could be left out. In addition, these examples show how the building blocks of Economy Studies can be combined to form coherent programmes.

This chapter is also intended to make clear once again: Economy Studies is not a blueprint of a single, ‘ideal’ curriculum. It is possible to design a wide variety of programmes with these building blocks, and it is our hope that they will be used for this. We firmly believe that the world is best served with a wide variety of economists. One size does not fit all.

Example Curricula:

- Bachelor in Economics with a Theoretical Focus

- Bachelor in Economics with a Real-World Focus

- Major Economics in a Liberal Arts and Sciences Programme

- Master in Public Economics

- Design Your Own Curriculum, Step by Step

- Master in Financial Economics

- Master in Economics of Climate Crises

- Research Master in Industrial Economics

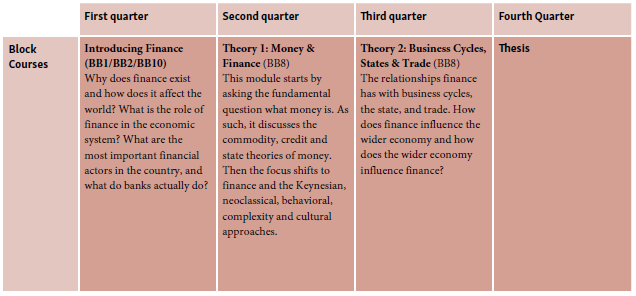

Example Curriculum 6: Master in Financial Economics

The typical graduate from this programme has a fundamental knowledge of the monetary and financial system of today, as well as its historical roots, counterparts and alternatives. They could work in an organisation such as a commercial bank, a central bank, a financial regulatory authority, the Ministry of Finance, or a consultancy firm.

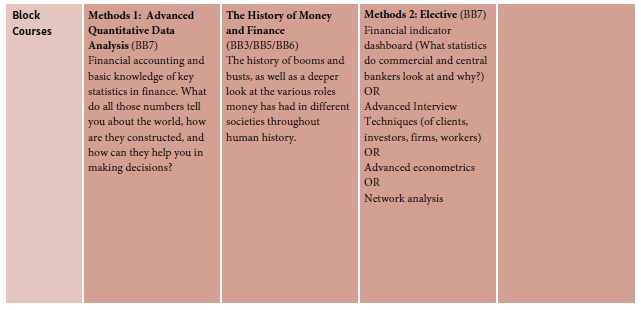

The programme starts with an introduction of finance as a sector: what it is, and how it is interrelated with other aspects of the economic system and wider society. This strand of exploration is continued in the second and third block with theoretical deep-dives and an historical exploration of the financial system. Alongside this mixture of theory and real world knowledge, students go deeper into the tools of quantitative analysis. This starts with a course on advanced quantitative methods such as financial accounting and financial statistics, and continues with an elective on either advanced econometrics or financial indicators. The capstone of the MSc programme is a 15-ECTS thesis that is practically oriented. Students can choose between topics provided by a partnering institution such as a commercial or central bank. In this way, students learn to conduct research on real-world issues and arrive at relevant conclusions.

Programme overview